It’s been a while since I last wrote an article. I have been on twitter more often just reading other people’s opinions on finance. The more I read, the more I realize the lack of knowledge there is when it comes to life insurance. Unfortunately everybody pushes an agenda and will directly say that a Index Universal Life policy is a bad plan. The common theme is “the fees”, as if other financial plans or institutions work for free. The cost of insurance is very low in comparison to the money earned in this type of plan.

Here are highlights about Index Universal Life policies:

-Death benefit which can increase with the cash value saved if that option is chosen.

-Tax- free growth.

-No limits on amount of contribution. The limitation is based off of the amount of coverage applied for.

-Flexible contributions: if you decide to contribute $1,000 a month and then can’t one month or for a period of time, you can decrease the amount contributed.

-Guaranteed not to lose money.

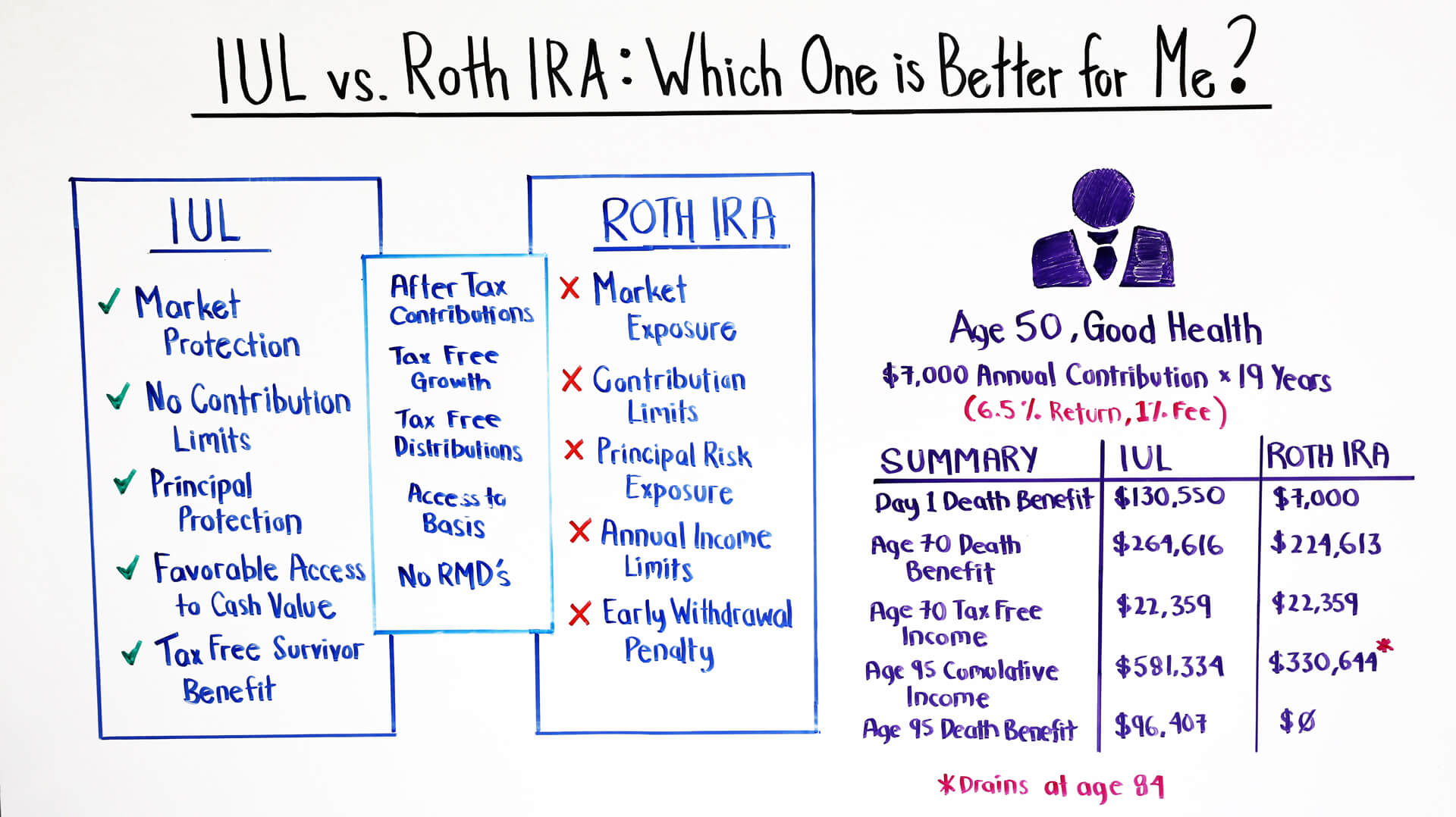

In the graph you can see the difference between one product and the other:

I was recently reviewing a plan for a client of mine who’s now 74 years- old. I met him randomly, just walking into his office and he was willing to sit down and listen to somebody half his age. He gave me a chance and applied for a small $50,000 policy back in 2014, probably to see “if this thing works and this kid is saying the truth”. 10 years later he has $9,522 saved, so his coverage is now at $59,522. “Oh, but if you invest directly in a ETF you can earn more interest”, true, but you don’t have coverage and you aren’t protected against losses either. There is no such thing as a perfect plan, although in my opinion the Index Universal Life is pretty close to it, but this is only my opinion.

Here are the details to his plan. Please keep in mind he’s a Senior, he should be contributing more but he just wanted to test this plan out:

Total contributions since 2014: $17,084. Divide that by 8 years, $2,135, divided by 12 that equals $178.

Total cash value: $9,522. Divide that by 8 years: $2,135, divided by 12 that equals $99.

What this means is that if you do 178-99= 79. $79 a month is his cost of insurance, which he applied for when he was 66 years- old, permanent policy and the rest gets accredited to his account. He just today finished his application for a 15 year policy for $150,000 with benefits if he gets critically or chronically ill. He opened this policy to have it in case something happens to him and his house can be paid off. By the way he’s had his own tax- firm for 25 years, in case you were wondering about his background and how much or how little he knows about saving and investing.

Life insurance is a very personal decision and don’t let an agent or an advisor tell you which one you should or shouldn’t purchase. Make sure you get all the details and always ask the agent to clarify any questions or doubts. The worst decision to make is the wrong one because it wasn’t explained.

I also do want to clarify that Roth IRA’s do have benefits as well: tax- free growth which you can start accessing after age 60 and no excise tax at 70 1/2. When purchasing a Roth, try to get some help from the Broker you are purchasing the plan to know where to invest the money and be able to maximize your contributions, but just know that it’s not guaranteed if the market goes down.